Page 166 - FBL AR 2019-20

P. 166

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Standalone financial statements for the year ended March 31, 2020

55 Financial risk management objectives and policies (contd.)

Exposure to credit risk

The carrying amount of financial assets represents the maximum credit exposure.

i) Trade receivables

The Company has used expected credit loss (ECL) model for assessing the impairment loss. For this purpose, the Company uses

a provision matrix to compute the expected credit loss amount. The provision matrix takes into account external and internal risk

factors and historical data of credit losses from various customers. The Company evaluates the concentration of risk with respect

to trade receivables which is low, as its customers are widely spread with small outstanding amounts (For detailed movement in

provision for trade receivables - Refer note 15)

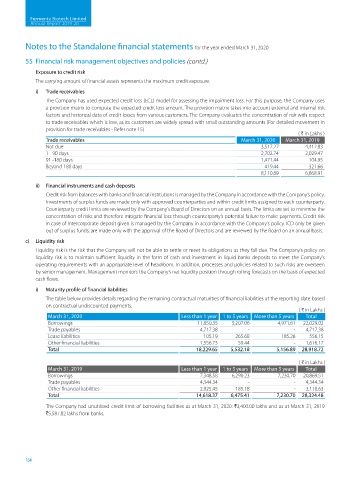

( H in Lakhs )

Trade receivables March 31, 2020 March 31, 2019

Not due 3,517.27 4,412.83

1 - 90 days 2,702.74 2,029.47

91 -180 days 1,471.44 104.95

Beyond 180 days 419.44 321.66

8,110.89 6,868.91

ii) Financial instruments and cash deposits

Credit risk from balances with banks and financial institutions is managed by the Company in accordance with the Company’s policy.

Investments of surplus funds are made only with approved counterparties and within credit limits assigned to each counterparty.

Counterparty credit limits are reviewed by the Company’s Board of Directors on an annual basis. The limits are set to minimise the

concentration of risks and therefore mitigate financial loss through counterparty’s potential failure to make payments. Credit risk

in case of Intercorporate deposit given is managed by the Company in accordance with the Company’s policy. ICD only be given

out of surplus funds, are made only with the approval of the Board of Directors and are reviewed by the Board on an annual basis.

c) Liquidity risk

Liquidity risk is the risk that the Company will not be able to settle or meet its obligations as they fall due. The Company’s policy on

liquidity risk is to maintain sufficient liquidity in the form of cash and investment in liquid banks deposits to meet the Company’s

operating requirements with an appropriate level of headroom. In addition, processes and policies related to such risks are overseen

by senior management. Management monitors the Company’s net liquidity position through rolling forecasts on the basis of expected

cash flows.

i) Maturity profile of financial liabilities

The table below provides details regarding the remaining contractual maturities of financial liabilities at the reporting date based

on contractual undiscounted payments.

( H in Lakhs )

March 31, 2020 Less than 1 year 1 to 5 years More than 5 years Total

Borrowings 11,850.35 5,207.06 4,971.61 22,029.02

Trade payables 4,717.38 - - 4,717.38

Lease liabilities 105.19 265.68 185.28 556.15

Other financial liabilities 1,556.73 59.44 - 1,616.17

Total 18,229.65 5,532.18 5,156.89 28,918.72

( H in Lakhs )

March 31, 2019 Less than 1 year 1 to 5 years More than 5 years Total

Borrowings 7,348.58 6,290.23 7,230.70 20,869.51

Trade payables 4,344.34 - - 4,344.34

Other financial liabilities 2,925.45 185.18 - 3,110.63

Total 14,618.37 6,475.41 7,230.70 28,324.48

The Company had unutilised credit limit of borrowing facilities as at March 31, 2020: H3,400.00 lakhs and as at March 31, 2019

H5,587.82 lakhs from banks.

164