Page 168 - FBL AR 2019-20

P. 168

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Standalone financial statements for the year ended March 31, 2020

57 Investment properties (contd.)

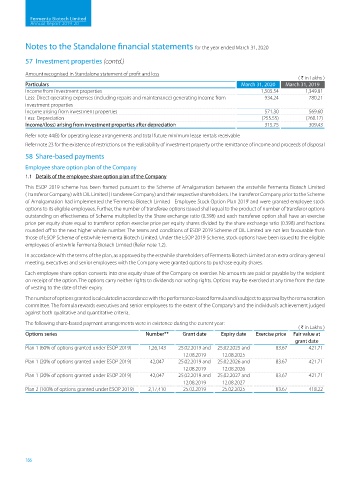

Amount recognised in Standalone statement of profit and loss

( H in Lakhs )

Particulars March 31, 2020 March 31, 2019

Income from investment properties 1,505.54 1,349.81

Less: Direct operating expenses (including repairs and maintenance) generating income from 934.24 780.21

investment properties

Income arising from investment properties 571.30 569.60

Less: Depreciation (255.55) (260.17)

Income/(loss) arising from investment properties after depreciation 315.75 309.43

Refer note 44(B) for operating lease arrangements and total future minimum lease rentals receivable

Refer note 23 for the existence of restrictions on the realisability of investment property or the remittance of income and proceeds of disposal

58 Share-based payments

Employee share option plan of the Company

1.1 Details of the employee share option plan of the Company

This ESOP 2019 scheme has been framed pursuant to the Scheme of Amalgamation between the erstwhile Fermenta Biotech Limited

(Transferor Company) with DIL Limited (Transferee Company) and their respective shareholders. The Transferor Company prior to the Scheme

of Amalgamation had implemented the ‘Fermenta Biotech Limited - Employee Stock Option Plan 2019’ and were granted employee stock

options to its eligible employees. Further, the number of transferee options issued shall equal to the product of number of transferor options

outstanding on effectiveness of Scheme multiplied by the Share exchange ratio (0.398) and each transferee option shall have an exercise

price per equity share equal to transferor option exercise price per equity shares divided by the share exchange ratio (0.398) and fractions

rounded off to the next higher whole number. The terms and conditions of ESOP 2019 Scheme of DIL Limited are not less favourable than

those of ESOP Scheme of erstwhile Fermenta Biotech Limited. Under the ESOP 2019 Scheme, stock options have been issued to the eligible

employees of erstwhile Fermenta Biotech Limited (Refer note 1.2).

In accordance with the terms of the plan, as approved by the erstwhile shareholders of Fermenta Biotech Limited at an extra ordinary general

meeting, executives and senior employees with the Company were granted options to purchase equity shares.

Each employee share option converts into one equity share of the Company on exercise. No amounts are paid or payable by the recipient

on receipt of the option. The options carry neither rights to dividends nor voting rights. Options may be exercised at any time from the date

of vesting to the date of their expiry.

The number of options granted is calculated in accordance with the performance-based formula and is subject to approval by the remuneration

committee. The formula rewards executives and senior employees to the extent of the Company’s and the individual’s achievement judged

against both qualitative and quantitative criteria.

The following share-based payment arrangements were in existence during the current year:

( H in Lakhs )

Options series Number** Grant date Expiry date Exercise price Fair value at

grant date

Plan 1 (60% of options granted under ESOP 2019) 1,26,143 25.02.2019 and 25.02.2025 and 83.67 421.71

12.08.2019 12.08.2025

Plan 1 (20% of options granted under ESOP 2019) 42,047 25.02.2019 and 25.02.2026 and 83.67 421.71

12.08.2019 12.08.2026

Plan 1 (20% of options granted under ESOP 2019) 42,047 25.02.2019 and 25.02.2027 and 83.67 421.71

12.08.2019 12.08.2027

Plan 2 (100% of options granted under ESOP 2019) 2,17,410 25.02.2019 25.02.2025 83.67 418.22

166