Page 165 - FBL AR 2019-20

P. 165

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Standalone financial statements for the year ended March 31, 2020

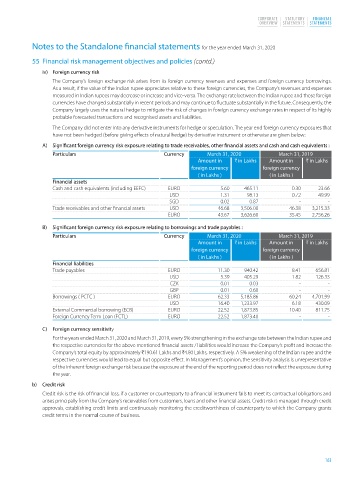

55 Financial risk management objectives and policies (contd.)

iv) Foreign currency risk

The Company’s foreign exchange risk arises from its foreign currency revenues and expenses and foreign currency borrowings.

As a result, if the value of the Indian rupee appreciates relative to these foreign currencies, the Company’s revenues and expenses

measured in Indian rupees may decrease or increase and vice-versa. The exchange rate between the Indian rupee and these foreign

currencies have changed substantially in recent periods and may continue to fluctuate substantially in the future. Consequently, the

Company largely uses the natural hedge to mitigate the risk of changes in foreign currency exchange rates in respect of its highly

probable forecasted transactions and recognised assets and liabilities.

The Company did not enter into any derivative instruments for hedge or speculation. The year end foreign currency exposures that

have not been hedged (before giving effects of natural hedge) by derivative instrument or otherwise are given below:

A) Significant foreign currency risk exposure relating to trade receivables, other financial assets and cash and cash equivalents :

Particulars Currency March 31, 2020 March 31, 2019

Amount in H in Lakhs Amount in H in Lakhs

foreign currency foreign currency

( in Lakhs ) ( in Lakhs )

Financial assets

Cash and cash equivalents (including EEFC) EURO 5.60 465.11 0.30 23.66

USD 1.31 98.13 0.72 49.99

SGD 0.02 0.87 - -

Trade receivables and other financial assets USD 46.68 3,506.00 46.38 3,215.33

EURO 43.67 3,626.60 35.45 2,756.26

B) Significant foreign currency risk exposure relating to borrowings and trade payables :

Particulars Currency March 31, 2020 March 31, 2019

Amount in H in Lakhs Amount in H in Lakhs

foreign currency foreign currency

( in Lakhs ) ( in Lakhs )

Financial liabilities

Trade payables EURO 11.30 940.42 8.41 656.81

USD 5.39 405.29 1.82 126.33

CZK 0.01 0.03 - -

GBP 0.01 0.60 - -

Borrowings ( PCFC ) EURO 62.33 5,185.86 60.24 4,701.99

USD 16.40 1,233.97 6.18 430.09

External Commercial borrowing (ECB) EURO 22.52 1,873.85 10.40 811.75

Foreign Currency Term Loan (FCTL) EURO 22.52 1,873.40 - -

C) Foreign currency sensitivity

For the years ended March 31, 2020 and March 31, 2019, every 5% strengthening in the exchange rate between the Indian rupee and

the respective currencies for the above mentioned financial assets / liabilities would increase the Company’s profit and increase the

Company’s total equity by approximately H190.61 Lakhs and H4.80 Lakhs, respectively. A 5% weakening of the Indian rupee and the

respective currencies would lead to equal but opposite effect. In Management’s opinion, the sensitivity analysis is unrepresentative

of the inherent foreign exchange risk because the exposure at the end of the reporting period does not reflect the exposure during

the year.

b) Credit risk

Credit risk is the risk of financial loss, if a customer or counterparty to a financial instrument fails to meet its contractual obligations and

arises principally from the Company’s receivables from customers, loans and other financial assets. Credit risk is managed through credit

approvals, establishing credit limits and continuously monitoring the creditworthiness of counterparty to which the Company grants

credit terms in the normal course of business.

163