Page 162 - FBL AR 2019-20

P. 162

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Standalone financial statements for the year ended March 31, 2020

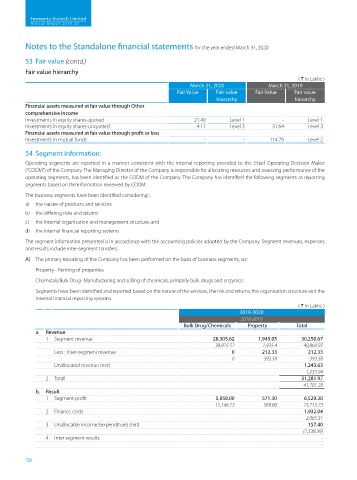

53 Fair value (contd.)

Fair value hierarchy

( H in Lakhs )

March 31, 2020 March 31, 2019

Fair Value Fair value Fair Value Fair value

hierarchy hierarchy

Financial assets measured at fair value through Other

comprehensive income

Investments in equity shares-quoted 21.49 Level 1 - Level 1

Investments in equity shares-unquoted 4.11 Level 3 51.64 Level 3

Financial assets measured at fair value through profit or loss

Investments in mutual funds - - 114.79 Level 2

54 Segment information:

Operating segments are reported in a manner consistent with the internal reporting provided to the Chief Operating Decision Maker

(“CODM”) of the Company. The Managing Director of the Company is responsible for allocating resources and assessing performance of the

operating segments, has been identified as the CODM of the Company. The Company has identified the following segments as reporting

segments based on the information reviewed by CODM.

The business segments have been identified considering :

a) the nature of products and services

b) the differing risks and returns

c) the internal organisation and management structure, and

d) the internal financial reporting systems

The segment information presented is in accordance with the accounting policies adopted by the Company. Segment revenues, expenses

and results include inter-segment transfers.

A) The primary reporting of the Company has been performed on the basis of business segments, viz:

Property - Renting of properties

Chemicals/Bulk Drug- Manufacturing and selling of chemicals, primarily bulk drugs and enzymes.

Segments have been identified and reported based on the nature of the services, the risk and returns, the organisation structure and the

internal financial reporting systems.

( H in Lakhs )

2019-2020

2018-2019

Bulk Drug/Chemicals Property Total

a. Revenue

1 Segment revenue 28,305.62 1,945.05 30,250.67

38,925.52 1,935.4 40,860.92

Less : Inter-segment revenue 0 212.33 212.33

0 393.58 393.58

Unallocated revenue (net) 1,243.63

1,233.94

2 Total 31,281.97

41,701.28

b. Result

1 Segment profit 5,958.00 571.30 6,529.30

15,146.13 569.60 15,715.73

2 Finance costs 1,932.04

2,065.31

3 Unallocable income/(expenditure) (net) 157.40

(1,538.39)

4 Inter segment results -

-

160