Page 69 - FBL AR 2019-20

P. 69

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

REPORT OF THE

BOARD OF DIRECTORS

Your Directors are pleased to present the 68th Annual Report along with the Audited financial statements for the financial year ended March

31, 2020.

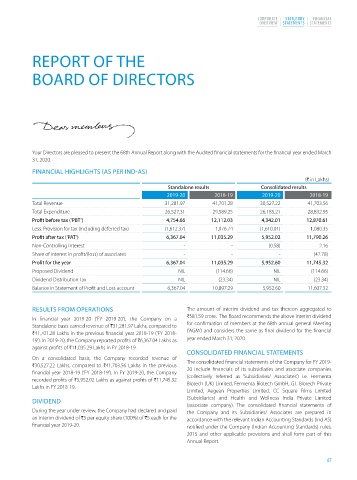

FINANCIAL HIGHLIGHTS (AS PER IND-AS)

(H in Lakhs)

Standalone results Consolidated results

2019-20 2018-19 2019-20 2018-19

Total Revenue 31,281.97 41,701.28 30,527.22 41,703.56

Total Expenditure 26,527.31 29,589.25 26,185.21 28,832.95

Profit before tax (‘PBT’) 4,754.66 12,112.03 4,342.01 12,870.61

Less: Provision for tax (including deferred tax) (1,612.37) 1,076.74 (1,610.01) 1,080.35

Profit after tax (‘PAT’) 6,367.04 11,035.29 5,952.02 11,790.26

Non-Controlling interest - - (0.58) 2.16

Share of interest in profit/(loss) of associates - - - (42.78)

Profit for the year 6,367.04 11,035.29 5,952.60 11,745.32

Proposed Dividend NIL (114.66) NIL (114.66)

Dividend Distribution Tax NIL (23.34) NIL (23.34)

Balance in Statement of Profit and Loss account 6,367.04 10,897.29 5,952.60 11,607.32

RESULTS FROM OPERATIONS The amount of interim dividend and tax thereon aggregated to

H581.59 crore. The Board recommends the above interim dividend

In financial year 2019-20 (‘FY 2019-20’), the Company on a

Standalone basis earned revenue of H31,281.97 Lakhs, compared to for confirmation of members at the 68th annual general Meeting

H41,701.28 Lakhs in the previous financial year 2018-19 (‘FY 2018- (‘AGM’) and considers the same as final dividend for the financial

19’). In 2019-20, the Company reported profits of H6,367.04 Lakhs as year ended March 31, 2020.

against profits of H11,035.29 Lakhs in FY 2018-19.

CONSOLIDATED FINANCIAL STATEMENTS

On a consolidated basis, the Company recorded revenue of

H30,527.22 Lakhs, compared to H41,703.56 Lakhs in the previous The consolidated financial statements of the Company for FY 2019-

financial year 2018-19 (‘FY 2018-19’). In FY 2019-20, the Company 20 include financials of its subsidiaries and associate companies

recorded profits of H5,952.02 Lakhs as against profits of H11,745.32 (collectively referred as ‘Subsidiaries/ Associates’) i.e. Fermenta

Lakhs in FY 2018-19. Biotech (UK) Limited, Fermenta Biotech GmbH, G.I. Biotech Private

Limited, Aegean Properties Limited, CC Square Films Limited

DIVIDEND (Subsidiaries) and Health and Wellness India Private Limited

(associate company). The consolidated financial statements of

During the year under review, the Company had declared and paid the Company and its Subsidiaries/ Associates are prepared in

an interim dividend of H5 per equity share (100%) of H5 each for the accordance with the relevant Indian Accounting Standards (Ind AS)

financial year 2019-20. notified under the Company (Indian Accounting Standards) rules,

2015 and other applicable provisions and shall form part of this

Annual Report.

67