Page 67 - FBL AR 2019-20

P. 67

Corporate Statutory FinanCial

overview StatementS StatementS

Key numbers

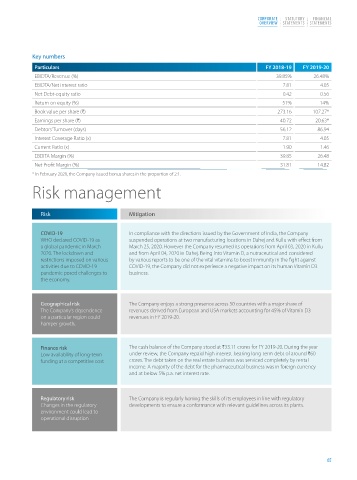

Particulars FY 2018-19 FY 2019-20

EBIDTA/Revenue (%) 39.85% 26.48%

EBIDTA/Net interest ratio 7.81 4.05

Net Debt-equity ratio 0.42 0.56

Return on equity (%) 51% 14%

Book value per share (H) 273.16 107.27*

Earnings per share (H) 40.72 20.63*

Debtors’ Turnover (days) 56.12 86.94

Interest Coverage Ratio (x) 7.81 4.05

Current Ratio (x) 1.90 1.46

EBDITA Margin (%) 39.85 26.48

Net Profit Margin (%) 31.81 14.82

* In February 2020, the Company issued bonus shares in the proportion of 2:1.

Risk management

Risk Mitigation

COVID-19 In compliance with the directions issued by the Government of India, the Company

WHO declared COVID-19 as suspended operations at two manufacturing locations in Dahej and Kullu with effect from

a global pandemic in March March 25, 2020. However the Company resumed its operations from April 03, 2020 in Kullu

2020. The lockdown and and from April 04, 2020 in Dahej. Being into Vitamin D, a nutraceutical and considered

restrictions imposed on various by various reports to be one of the vital vitamins to boost immunity in the fight against

activities due to COVID-19 COVID-19, the Company did not experience a negative impact on its human Vitamin D3

pandemic posed challenges to business.

the economy.

Geographical risk The Company enjoys a strong presence across 50 countries with a major share of

The Company’s dependence revenues derived from European and USA markets accounting for 45% of Vitamin D3

on a particular region could revenues in FY 2019-20.

hamper growth.

Finance risk The cash balance of the Company stood at H33.11 crores for FY 2019-20. During the year

Low availability of long-term under review, the Company repaid high interest-bearing long-term debt of around H60

funding at a competitive cost crores. The debt taken on the real estate business was serviced completely by rental

income. A majority of the debt for the pharmaceutical business was in foreign currency

and at below 5% p.a. net interest rate.

Regulatory risk The Company is regularly honing the skills of its employees in line with regulatory

Changes in the regulatory developments to ensure a conformance with relevant guidelines across its plants.

environment could lead to

operational disruption

65