Page 209 - FBL AR 2019-20

P. 209

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Consolidated financial statements for the year ended March 31, 2020

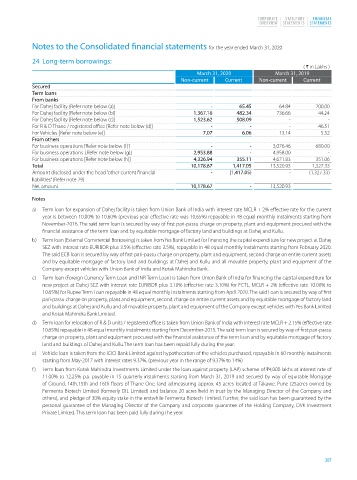

24 Long-term borrowings:

( H in Lakhs )

March 31, 2020 March 31, 2019

Non-current Current Non-current Current

Secured

Term loans

From banks

For Dahej facility [Refer note below (a)] - 65.45 64.84 200.00

For Dahej facility [Refer note below (b)] 1,367.16 482.34 736.66 44.24

For Dahej facility [Refer note below (c)] 1,523.62 508.09 - -

For R & D Thane / registered office [Refer note below (d)] - - - 46.51

For Vehicles [Refer note below (e)] 7.07 6.06 13.14 5.52

From others

For business operations [Refer note below (f)] - - 3,076.46 680.00

For business operations [Refer note below (g)] 2,953.88 - 4,958.00 -

For business operations [Refer note below (h)] 4,326.94 355.11 4,671.83 351.06

Total 10,178.67 1,417.05 13,520.93 1,327.33

Amount disclosed under the head “other current financial - (1,417.05) - (1,327.33)

liabilities” (Refer note 29)

Net amount 10,178.67 - 13,520.93 -

Notes

a) Term loan for expansion of Dahej facility is taken from Union Bank of India with interest rate MCLR + 2% effective rate for the current

year is between 10.00% to 10.60% (previous year effective rate was 10.65%) repayable in 48 equal monthly instalments starting from

November-2016. The said term loan is secured by way of first pari-passu charge on property, plant and equipment procured with the

financial assistance of the term loan and by equitable mortgage of factory land and buildings at Dahej and Kullu.

b) Term loan (External Commercial Borrowing) is taken from Yes Bank Limited for financing the capital expenditure for new project at Dahej

SEZ with interest rate EURIBOR plus 3.5% (effective rate 3.5%), repayable in 48 equal monthly instalments starting from February 2020.

The said ECB loan is secured by way of first pari-passu charge on property, plant and equipment, second charge on entire current assets

and by equitable mortgage of factory land and buildings at Dahej and Kullu and all movable property, plant and equipment of the

Company except vehicles with Union Bank of India and Kotak Mahindra Bank.

c) Term loan (Foreign Currency Term Loan and INR Term Loan) is taken from Union Bank of India for financing the capital expenditure for

new project at Dahej SEZ with interest rate EURIBOR plus 3.10% (effective rate 3.10%) for FCTL, MCLR + 2% (effective rate 10.00% to

10.65%) for Rupee Term Loan repayable in 48 equal monthly instalments starting from April 2020. The said Loan is secured by way of first

pari-passu charge on property, plant and equipment, second charge on entire current assets and by equitable mortgage of factory land

and buildings at Dahej and Kullu and all movable property, plant and equipment of the Company except vehicles with Yes Bank Limited

and Kotak Mahindra Bank Limited.

d) Term loan for relocation of R & D units / registered office is taken from Union Bank of India with interest rate MCLR + 2.15% (effective rate

10.65%) repayable in 48 equal monthly instalments starting from December-2015. The said term loan is secured by way of first pari-passu

charge on property, plant and equipment procured with the financial assistance of the term loan and by equitable mortgage of factory

land and buildings of Dahej and Kullu.The term loan has been repaid fully during the year.

e) Vehicle loan is taken from the ICICI Bank Limited against hypothecation of the vehicles purchased, repayable in 60 monthly instalments

starting from May-2017 with interest rates 9.37%, (previous year in the range of 9.37% to 14%)

f) Term loan from Kotak Mahindra Investments Limited under the loan against property (LAP) scheme of H4,000 lakhs at interest rate of

11.00% to 12.25% p.a. payable in 15 quarterly instalments starting from March 31, 2019 and secured by way of equitable Mortgage

of Ground, 14th,15th and 16th floors of Thane One, land admeasuring approx. 45 acres located at Takawe, Pune (25acres owned by

Fermenta Biotech Limited (formerly DIL Limited) and balance 20 acres held in trust by the Managing Director of the Company and

others), and pledge of 30% equity stake in the erstwhile Fermenta Biotech Limited. Further, the said loan has been guaranteed by the

personal guarantee of the Managing Director of the Company and corporate guarantee of the Holding Company, DVK Investment

Private Limited. This term loan has been paid fully during the year.

207