Page 218 - FBL AR 2019-20

P. 218

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Consolidated financial statements for the year ended March 31, 2020

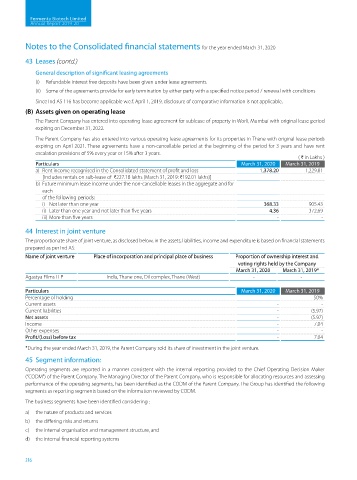

43 Leases (contd.)

General description of significant leasing agreements

(i) Refundable interest free deposits have been given under lease agreements.

(ii) Some of the agreements provide for early termination by either party with a specified notice period / renewal with conditions

Since Ind AS 116 has become applicable w.e.f. April 1, 2019, disclosure of comparative information is not applicable.

(B) Assets given on operating lease

The Parent Company has entered into operating lease agreement for sublease of property in Worli, Mumbai with original lease period

expiring on December 31, 2022.

The Parent Company has also entered into various operating lease agreements for its properties in Thane with original lease periods

expiring on April 2021. These agreements have a non-cancellable period at the beginning of the period for 3 years and have rent

escalation provisions of 5% every year or 15% after 3 years.

( H in Lakhs )

Particulars March 31, 2020 March 31, 2019

a) Rent income recognised in the Consolidated statement of profit and loss 1,378.20 1,229.81

[Includes rentals on sub-lease of H227.18 lakhs (March 31, 2019: H192.01 lakhs)]

b) Future minimum lease income under the non-cancellable leases in the aggregate and for

each

of the following periods:

i) Not later than one year 368.33 905.43

ii) Later than one year and not later than five years 4.36 372.69

iii) More than five years - -

44 Interest in joint venture

The proportionate share of joint venture, as disclosed below, in the assets, liabilities, income and expenditure is based on financial statements

prepared as per Ind AS:

Name of joint venture Place of incorporation and principal place of business Proportion of ownership interest and

voting rights held by the Company

March 31, 2020 March 31, 2019*

Agastya Films LLP India, Thane one, Dil complex, Thane (West) - -

Particulars March 31, 2020 March 31, 2019

Percentage of holding - 50%

Current assets - -

Current liabilities - (5.97)

Net assets - (5.97)

Income - 7.04

Other expenses - -

Profit/(Loss) before tax - 7.04

*During the year ended March 31, 2019, the Parent Company sold its share of investment in the joint venture.

45 Segment information:

Operating segments are reported in a manner consistent with the internal reporting provided to the Chief Operating Decision Maker

(“CODM”) of the Parent Company. The Managing Director of the Parent Company, who is responsible for allocating resources and assessing

performance of the operating segments, has been identified as the CODM of the Parent Company. The Group has identified the following

segments as reporting segments based on the information reviewed by CODM.

The business segments have been identified considering :

a) the nature of products and services

b) the differing risks and returns

c) the internal organisation and management structure, and

d) the internal financial reporting systems

216